Using precise terminology is crucial in financial contexts, as even minor misunderstandings can lead to significant consequences. This is particularly true when it comes to terms like “payor” and “payer,” which often appear in legal documents and financial agreements.

While both terms seem similar, understanding the subtle differences between them can enhance clarity and professionalism in your communication.

Understanding Payor and Payer

Payor: Definition and Usage

The term “payor” is primarily used in legal and formal documents to refer to the individual or entity making a payment. It is most commonly seen in the context of financial agreements, insurance policies, and legal contracts. For example:

- Legal documents: Wills, contracts, and property deeds often stipulate the “payor” responsible for fulfilling financial obligations.

- Insurance policies: Life insurance policies identify the “payor” who pays the premiums to keep the policy active.

- Financial agreements: Loan agreements or credit card terms may specify the “payor” obligated to make the repayments.

Payer: Definition and Usage

On the other hand, the term “payer” has a broader scope and is commonly used in everyday financial transactions and general business contexts. It simply refers to any party that gives money to another party, usually in exchange for goods, or services, or to settle a financial obligation.

For instance:

- Everyday transactions: The person paying the bill at a restaurant or making an online purchase is considered the “payer.”

- Healthcare: Insurance companies are often referred to as “payers” when they reimburse medical expenses.

- Business dealings: In invoices and purchase orders, the “payer” is the entity responsible for settling the payment.

Side-by-Side Comparison

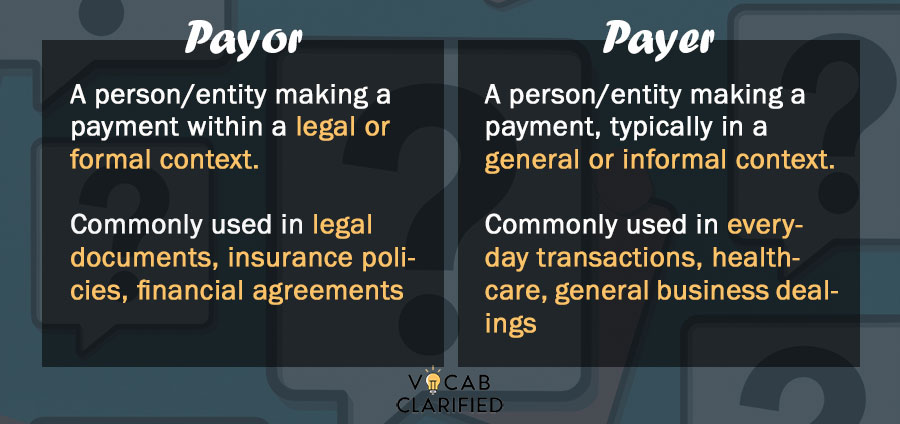

| Aspect | Payor | Payer |

| Definition | A person/entity making a payment within a legal or formal context. | A person/entity making a payment, typically in a general or informal context. |

| Common Usage | Legal documents, insurance policies, financial agreements | Everyday transactions, healthcare, general business dealings |

| Origin | More formal, with roots in legal terminology. | More general, evolved from everyday language. |

| Examples of Documents | Wills, contracts, property deeds, loan agreements, credit card terms | Bills, receipts, invoices, purchase orders |

Choosing the Right Term

When deciding between “payor” and “payer,” consider the formality and context:

- Formal contexts: If you’re dealing with legal documents, financial agreements, or specific roles within formal contracts, “payor” is generally the preferred term due to its precise and legalistic connotation.

- Informal contexts: In most other situations, especially casual conversations or general business communications, “payer” is more appropriate due to its general and widely understood nature.

Everyday Usage Examples

- When drafting a will or legal testament, specifying the “payor” of any debts or legacies is essential to ensure clarity and legal correctness.

- When filling out a tax form or making an online payment, the term “payer” is typically used to refer to the individual or business making the payment.

FAQ: Payor vs. Payer

The difference lies in context: “payor” is often used in legal and formal documents, like insurance policies. On the other hand, “payer” is common in general finance and everyday transactions.

Use “payor” in formal contexts, such as legal agreements or insurance contracts. “Payer” is better suited for general financial documents and casual settings.

In healthcare billing, “payer” is more commonly used to refer to entities like insurance companies that cover costs.

While they can be technically interchangeable, “payor” is recommended for a more formal tone in contracts and legal documents.

Examples of a “payer” include an individual paying at a restaurant, a customer buying online, or a company settling an invoice.

No, “payor” can refer to both individuals and entities, such as companies or governments that are making payments in formal contexts.

Think of “payor” for formal, legal settings (like agreements) and “payer” for everyday, less formal transactions.

Conclusion

Now that you have explored the nuances between “payor” and “payer,” the distinction should be clearer. Remember, the key to mastering these terms lies in understanding their most appropriate contexts and uses.

Use this guide as a reference, and soon, deciding between “payor” or “payer” won’t be an issue, ensuring precision and professionalism in your financial and legal communications.